Explain the Difference Between a 1040 and 1040ez Tax Form.

The third IRS tax form is the Form 1040A which is the shortest version of the more detailed Form 1040. 1040A Form 1040A is a shortened variation of Form 1040.

What Is The 1040 And What S The Difference Between The 1040 1040a And 1040ez

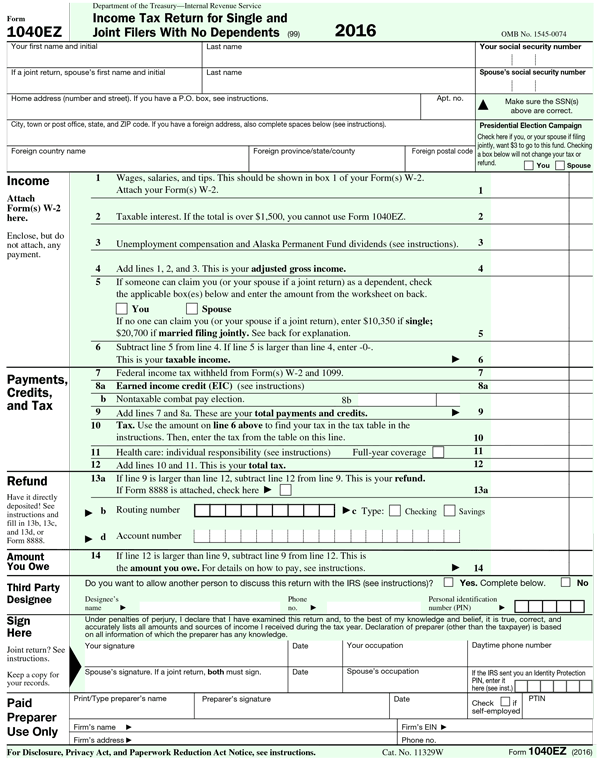

IRS 1040EZ is the shortest form that can be used to file taxes and is.

. Senior Tax Expert. 1040 Income or combined incomes over 50000 Itemized Deductions Self-employment income Income from sale of property If you cannot use form 1040EZ or Form 1040A you probably need a Form 1040. In simple terms 1040EZ is the easiest of the 1040 Forms to fill out vs.

The difference between 1040a tax forms and 1040ez tax forms is that it depends on if the person is a dependent or an independent It also matters on how much you make. Easily File Your 1040EZ Now. IRS1040 is a detailed form of the Internal Revenue Service IRS that taxpayers use to file their annual income tax returns whereas IRS 1040A is a simplified version of the IRS1040 form to report individual income tax.

Used mostly by single or married individuals with no dependents the EZ version of the 1040 bypasses the complexity of. As the name suggests the 1040EZ is a pretty basic individual filing tax form. You will need to file Form 1040X to amend the return then attach a properly- completed Form 1040NR-EZ with Form 8843.

The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. Print the word AMENDED on the top of the Form 1040NR-EZ. Heres the difference between tax forms 1040 1040A and 1040EZ.

Difference Between 1040 and 1040EZ The IRS Form 1040 and 1040EZ are two of the three forms used to file an individuals federal income tax returns. Since these forms are virtually identical in function the main reason to use Form 1040-SR is if youre filling out your tax return by hand rather than online. Filing Extension and Other Relief for Form 1040 Filers PDF -- 29-MAR-2021.

No Tax Knowledge Needed. Feb 1 2013 0930 PM. Form 1040-SR was created specifically for seniors who are at least 65 years old by the end of the tax year in which they are filing.

2 Print Or Taxes File Online - 100 Free. While anyone can file Form 1040. Explain the difference between a regressive tax and a progressive tax.

You may have received a Form 1040A or 1040EZ in the mail because of the. This is known as A adjusted gross income B itemized deductions. New Exclusion of up to 10200 of Unemployment Compensation -- 24-MAR-2021.

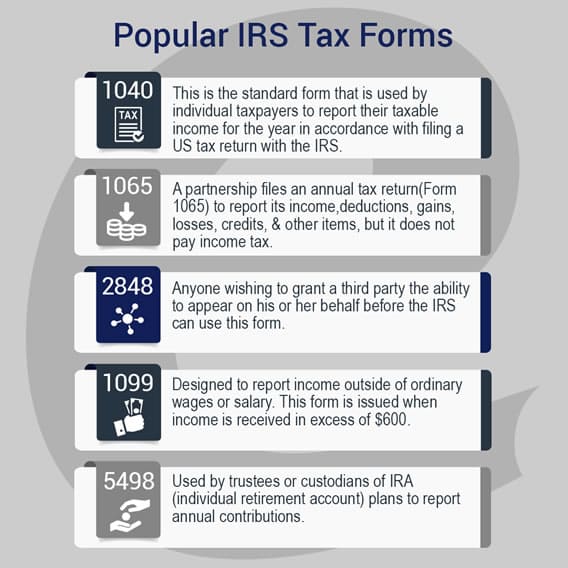

While a 1040 and a W-2 transcript clearly contain different data another key difference between a W-2 and 1040 transcript is how long you have to request them. Each of these has its own 1099 form on which it is reported. Its for people 65 and older.

The standard 1040 form is the most complex of the three while the 1040EZ is the simplest hence its nickname of simple income tax return and the 1040A is somewhere in the middle. Form 1040-SR is a new version of Form 1040. The Internal Revenue Service IRS the tax collection agency of the United States federal.

The 1040-SR has a different color. You can itemize or list them on Form 1040 thus reducing your overall income tax bill. Items that can be reported on a Form 1040-SR tax return.

If you are self-employed itemize. A A regressive tax is a fee thats applied uniformly. 1040EZ B 1040A C 1040 D 43110.

These claims are also folded into the new Form 1040. You use Form 1040-ES to pay income tax self-employment tax and any other tax you may be liable for. What is the difference between.

In addition to wages salary and tips for example your income couldve also included dividends pensions annuities IRAs and capital gains distributions. A 1040 formA 1040 form on the other hand is a tax return form that a taxpayer fills out. Reporting Excess Deductions on Termination of an Estate or Trust on.

The taxpayers marital status. The IRS has a list of items which if reported on your return require using either the Form 1040A or Form 1040 instead of Form 1040EZ. The basic differences between the 1040-SR and the regular 1040 tax form are cosmetic.

A slightly more complex Form 1040. A tax return transcript is only available for the current tax year and three prior tax years. Other income requirements for Form 1040A differ from 1040EZ in that they allowed you to include a broader category of income.

While the 1040 relates to the previous year the estimated tax form calculates taxes for the current year. Form 1040 1040-SR or 1040-NR line 3a Qualified dividends -- 06-APR-2021. Ad File Your 1040ez Tax Form for Free.

The most notable difference between Form 1040 and Form 1040-SR is. Cant use 1040EZ when listing dependents. Form 1040-SR has larger type and larger boxes to write numbers in making it slightly easier for seniors to read and fill out.

Form 1040-EZ is not surprisingly the easiest to fill out. This variation in complexity stems from factors such as. W-2 transcripts cover a much longer period and are available for up to 10 prior years.

The key differences between IRS 1040 1040A and 1040EZ are as follows. Ad Answer Simple Questions About Your Life And We Do The Rest. The taxpayer along with listing other income sources includes income that is filled out on the 1099 forms that that person received.

You can use the 1040 to report all types of income deductions and credits. Expect to pay additional tax and interest with each amendment but you can ask for a waiver of penalties. Form 1040 Anyone can use Form 1040 regardless of whether they qualify to use the 1040EZ or 1040A.

TurboTax Makes It Easy To Get Your Taxes Done Right. However if you are married and filing jointly only one taxpayer must meet this age requirement. 1040-A is longer and a bit more complex and Form 1040 is the most detailed and challenging of the lot.

For the 2021 tax year you must have been born before January 2 1957. Ad 1 Make Form 1040-EZ In Your Browser. IRS Statement - American Rescue Plan Act of 2021.

TABLE OF CONTENTS Who pays estimated tax. The only real difference between the forms is in the amount of information reported. How much taxable income the taxpayer has.

What Is The Difference Between Tax Forms 1040 1040a And 1040ez

Comments

Post a Comment